Platinum Prices 2025, Chart & History Overview | IMARC

Platinum Price Trends Analysis in North America: Q2 2025 Overview

Platinum Prices in the United States:

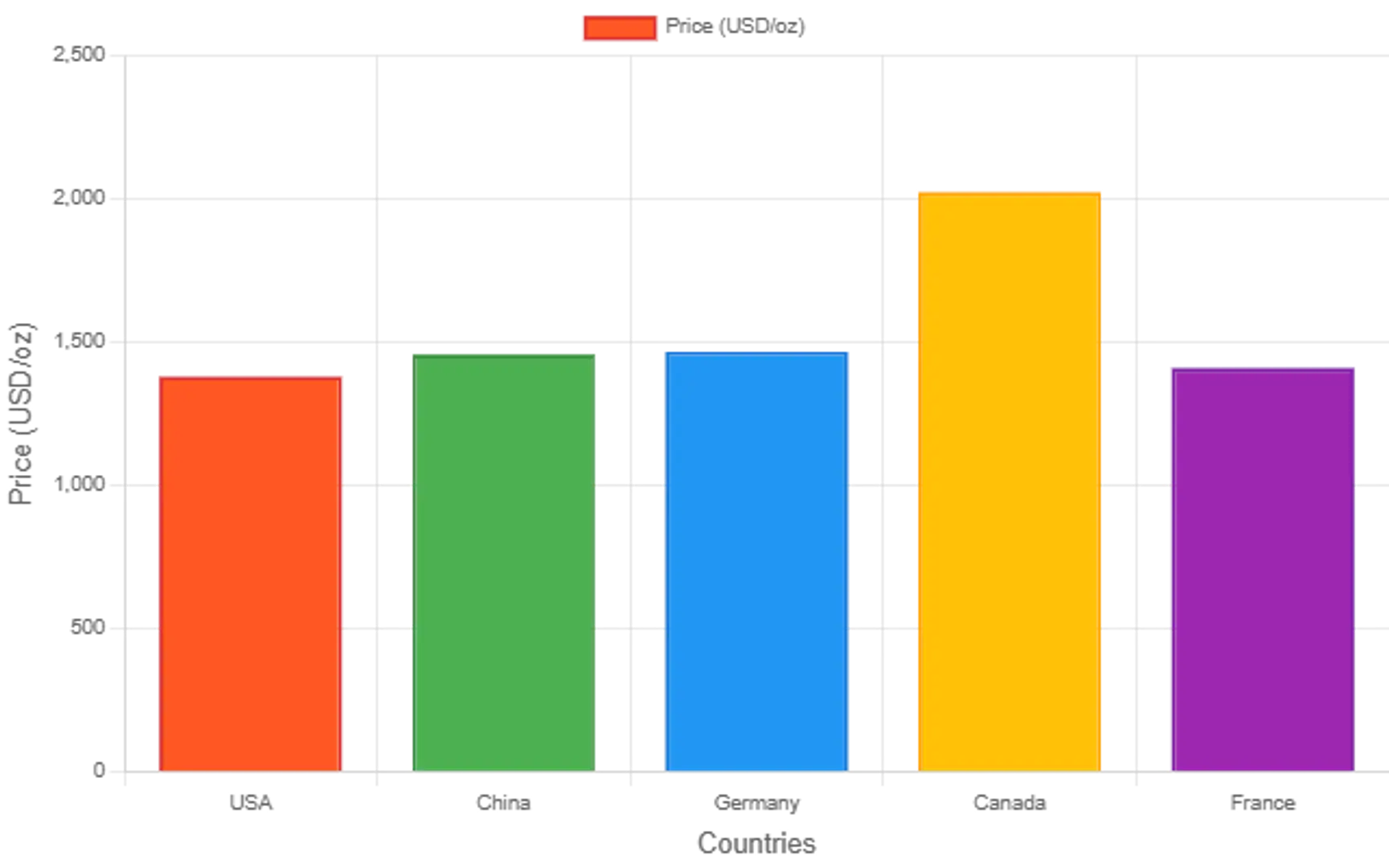

In Q2 2025, platinum prices in the USA stood at US$1,380/oz, reflecting moderate demand from the automotive and jewelry sectors. The Platinum Price Index highlights steady movements with minor fluctuations tied to industrial demand. When reviewed alongside the Platinum Price History Chart, the data indicates stability compared to global benchmarks, making the US market a crucial reference for traders and manufacturers.

Get the Real-Time Prices Analysis: https://www.imarcgroup.com/platinum-pricing-report/requestsample

Note: Personalized reports to meet your exact specifications

Platinum Price Trends Analysis in APAC: Q2 2025 Overview

Platinum Prices in China:

China recorded platinum prices of US$1,456/oz in Q2 2025, driven by strong industrial and manufacturing demand. The Platinum Price Index here shows a gradual upward trend as domestic industries relied on platinum for catalytic converters and electronics. Reviewing the Platinum Price History Chart, it is evident that China maintains consistent price growth, cementing its role as a leading consumer and influencer of global market trends.

Regional Analysis: The price analysis can be extended to provide detailed Platinum price information for the following list of countries.

China, India, Indonesia, Pakistan, Bangladesh, Japan, Philippines, Vietnam, Thailand, South Korea, Malaysia, Nepal, Taiwan, Sri Lanka, Hong Kong, Singapore, Australia, and New Zealand, among other Asian countries.

Platinum Price Trends Analysis in Europe: Q2 2025 Overview

Platinum Prices in Germany:

Platinum prices in Germany averaged US$1,467/oz during Q2 2025. The country’s reliance on automotive and industrial applications kept the Platinum Price Index relatively firm. Insights from the Platinum Price History Chart show Germany’s market has followed global upward patterns with occasional spikes. The balance between domestic consumption and European demand strengthens Germany’s position as one of the key platinum pricing hubs in the region.

Regional Analysis: The price analysis can be expanded to include detailed Platinum price data for a wide range of European countries:

such as Germany, France, the United Kingdom, Italy, Spain, Russia, Turkey, the Netherlands, Poland, Sweden, Belgium, Austria, Ireland, Switzerland, Norway, Denmark, Romania, Finland, the Czech Republic, Portugal, and Greece, along with other European nations.

Platinum Price Trends Analysis in North America: Q2 2025 Overview

Platinum Prices in Canada:

Canada saw the highest regional price at US$2,023/oz in Q2 2025, reflecting tighter supplies and robust industrial activity. The Platinum Price Index indicates a sharp rise compared to other global markets. When analyzed through the Platinum Price History Chart, this premium pricing highlights Canada’s unique supply-demand dynamics, particularly influenced by local mining and resource policies, making it a standout player in the platinum industry.

Regional Analysis: The price analysis can be extended to provide detailed Platinum price information for the following list of countries.

Platinum Price Trends Analysis in Europe: Q2 2025 Overview

Platinum Prices in France:

In France, platinum prices averaged US$1,409/oz in Q2 2025. The Platinum Price Index shows modest stability, reflecting steady demand from the jewelry sector and light industrial use. A review of the Platinum Price History Chart suggests France’s market moves closely in line with broader European pricing, providing traders and businesses with a dependable benchmark for evaluating short-term and long-term investment opportunities in platinum.

Regional Analysis: The price analysis can be expanded to include detailed Platinum price data for a wide range of European countries:

such as Germany, France, the United Kingdom, Italy, Spain, Russia, Turkey, the Netherlands, Poland, Sweden, Belgium, Austria, Ireland, Switzerland, Norway, Denmark, Romania, Finland, the Czech Republic, Portugal, and Greece, along with other European nations.

Factors Affecting Platinum Price Trend, Index & Forecast (2025–2026)

- Supply Constraints: Limited mine output, power issues, and labor disruptions—especially in South Africa—tighten global supply and push prices higher.

- Industrial & Jewelry Demand: Strong demand from automotive catalysts, green hydrogen, fuel cells, and robust jewelry markets (notably in China) drives price growth.

- Market Deficits: Ongoing supply deficits and low inventories add upward pressure, even as above-ground stocks offer some short-term stability.

- Trade & Geopolitics: Tariff uncertainty and shifting trade policies impact market flows and sentiment.

- Substitution Risk: If prices rise significantly, manufacturers may switch to alternatives like palladium, potentially capping gains.

- Automotive Trends: The increasing shift to electric vehicles may moderate future demand for platinum in emissions control.

Platinum Pricing Forecast Data:

Platinum prices are expected to remain strong through 2026 due to supply challenges and industrial demand, with potential for volatility from trade, substitution, or shifts in global auto markets.

Key Coverage:

- Market Analysis

- Market Breakup by Region

- Demand Supply Analysis by Type

- Demand Supply Analysis by Application

- Demand Supply Analysis of Raw Materials

- Price Analysis

- Spot Prices by Major Ports

- Price Breakup

- Price Trends by Region

- Factors Influencing the Price Trends

- Market Drivers, Restraints, and Opportunities

- Competitive Landscape

- Recent Developments

- Global Event Analysis

FAQs About the Platinum Prices Trend, Indax, and Forecast:

What factors influence the global Platinum Price Index in 2025?

Global platinum prices are shaped by industrial demand, especially in automotive catalysts, jewelry consumption, mining supply, and geopolitical trade shifts. Understanding these drivers helps businesses make smarter purchasing and investment decisions.

How can the Platinum Price History Chart help in predicting future trends?

The Platinum Price History Chart provides a clear view of long-term pricing movements. By analyzing past fluctuations, buyers and investors can better forecast future price shifts and plan procurement strategies effectively.

Why are Platinum Prices different across regions like the USA, China, and Europe?

Regional platinum prices vary due to import duties, mining costs, industrial consumption, and currency exchange rates. These variations make the Platinum Price Index a valuable tool for comparing global markets.

What is the outlook for Platinum Prices in the next quarter?

According to global demand research, platinum is expected to remain stable with potential upward momentum, supported by industrial usage and investment demand. Monitoring the Platinum Price Index helps businesses stay updated on short-term shifts.

How can I access detailed Platinum pricing data and forecasts?

You can access region-wise pricing data, Platinum Price Index, and long-term forecasts in our Platinum Pricing Report, designed to support procurement, market research, and strategic decision-making.

How IMARC Pricing Database Can Help

The latest IMARC Group study, “Platinum Prices, Trend, Chart, Demand, Market Analysis, News, Historical and Forecast Data 2025 Edition,” presents a detailed analysis of the Platinum price trend, offering key insights into global Platinum market dynamics. This report includes comprehensive price charts, which trace historical data and highlight major shifts in the market.

The analysis delves into the factors driving these trends, including raw material costs, production fluctuations, and geopolitical influences. Moreover, the report examines Platinum demand, illustrating how consumer behaviour and industrial needs affect overall market dynamics. By exploring the intricate relationship between supply and demand, the prices report uncovers critical factors influencing current and future prices.

About Us:

IMARC Group is a global management consulting firm that provides a comprehensive suite of services to support market entry and expansion efforts. The company offers detailed market assessments, feasibility studies, regulatory approvals, and licensing support, as well as pricing analysis, including spot pricing and regional price trends. Its expertise spans demand-supply analysis, alongside regional insights covering the Asia-Pacific, Europe, North America, Latin America, the Middle East, and Africa. IMARC also specializes in competitive landscape evaluations, profiling key market players, and conducting research into market drivers, restraints, and opportunities. IMARC’s data-driven approach helps businesses navigate complex markets with precision and confidence.

Contact Us:

IMARC Group

134 N 4th St., Brooklyn, NY 11249, USA

Email: sales[@]imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

Related Posts

© 2025 Invastor. All Rights Reserved

User Comments