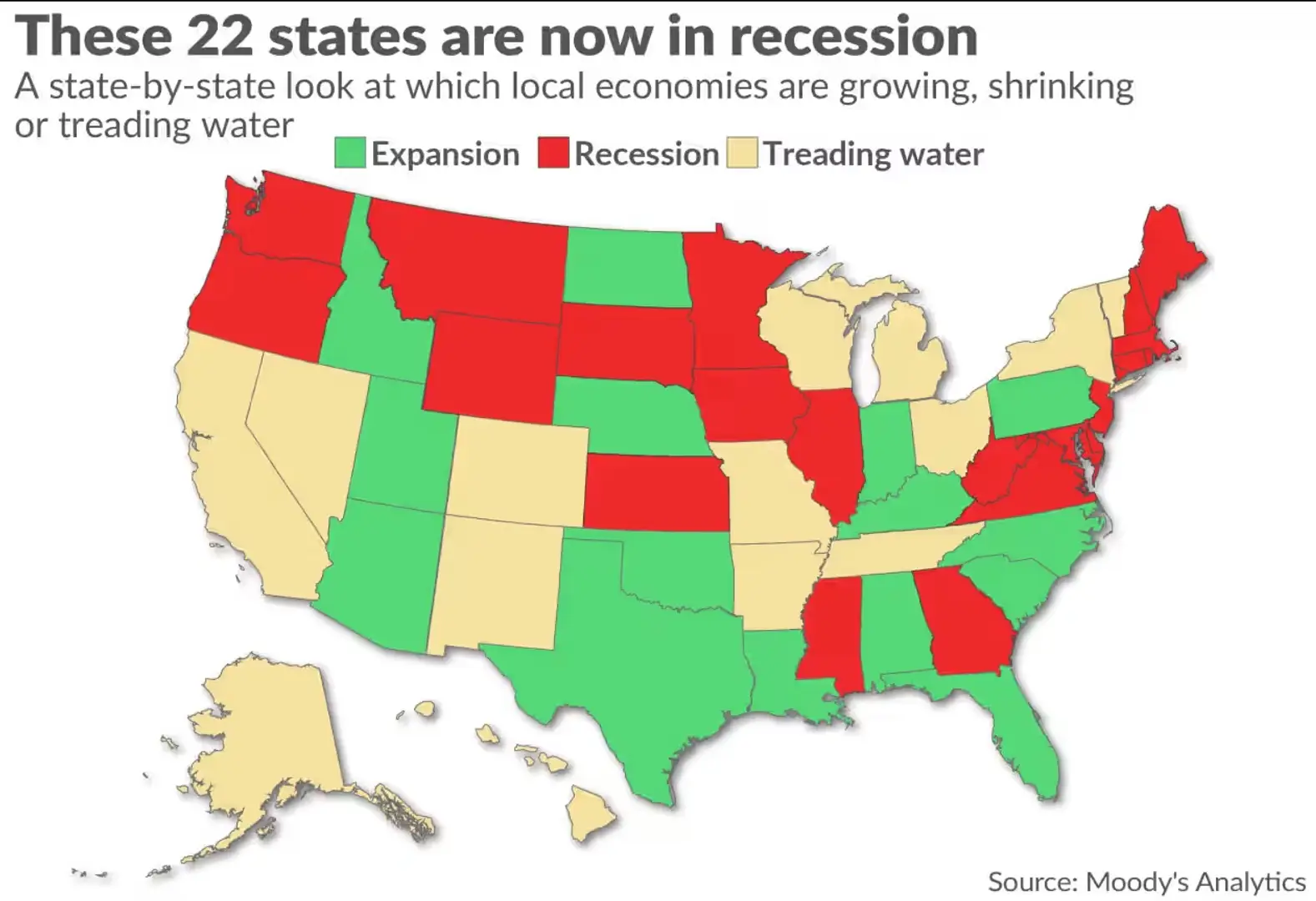

Economic analysts from Moody's Analytics estimate that 22 states and Washington, D.C., are effectively in a recession.

As of early October 2025, the economic landscape across the United States is showing concerning signs, with analysts from Moody's Analytics reporting that 22 states and Washington, D.C. are effectively in a recession. This assessment is based on various economic indicators, including declining GDP, rising unemployment rates, and decreased consumer spending.

To understand the implications of this recession, it is essential to examine the factors contributing to the downturn:

- Declining GDP: Many states have reported negative growth rates over consecutive quarters. For instance, states like California and New York have seen significant contractions in their economic output, largely due to reduced consumer and business spending.

- Unemployment Rates: The unemployment rate has climbed in several states, with Michigan and Ohio experiencing notable increases. Job losses in key industries such as manufacturing and retail have exacerbated the economic strain.

- Consumer Spending: As households tighten their budgets in response to economic uncertainty, consumer spending has slowed dramatically. States that rely heavily on tourism, like Florida and Nevada, are particularly vulnerable to this trend, as fewer travelers contribute to local economies.

The effects of this recession are not uniform across the country. For example, while states like Texas and Florida may be experiencing economic challenges, their robust economies and diverse industries could provide some resilience compared to more vulnerable states. Conversely, states with less economic diversity, such as West Virginia and Alaska, may face steeper declines due to their reliance on specific industries like coal mining and oil extraction.

Furthermore, the economic challenges are compounded by external factors such as:

- Inflation: Persistently high inflation rates have eroded consumer purchasing power, leading to decreased spending. Essential goods and services have become more expensive, straining household budgets.

- Federal Policy Changes: Shifts in federal monetary policy, including interest rate hikes aimed at controlling inflation, have made borrowing more expensive, impacting investment and spending.

- Global Economic Conditions: International factors such as supply chain disruptions and geopolitical tensions continue to affect the U.S. economy, further complicating recovery efforts.

In response to these challenges, state governments may implement various strategies to stimulate their economies. These strategies could include:

- Infrastructure Investment: States may prioritize infrastructure projects to create jobs and stimulate economic activity.

- Tax Relief: Implementing tax relief measures can help alleviate the financial burden on households and encourage spending.

- Support for Affected Industries: Targeted assistance programs for industries hit hardest by the recession, such as tourism and hospitality, can help stabilize these sectors.

As we move forward, the recovery from this recession will depend on a combination of effective policy responses, consumer confidence, and broader economic conditions. Analysts will be closely monitoring these developments to assess the potential for recovery in the coming months.

For further reading and updates on this economic situation, you can refer to the latest reports from Moody's Analytics and other economic research organizations.

photo credit: Moody analytics

Related Posts

© 2025 Invastor. All Rights Reserved

User Comments