Has the U.S. dollar been fully privatized?

The U.S. dollar has not been fully privatized; rather, it operates within a framework that combines both public and private elements. The U.S. dollar is issued and regulated by the Federal Reserve, which is the central bank of the United States. The Federal Reserve is an independent entity within the government, meaning it has the authority to manage monetary policy without direct political interference.

While the Federal Reserve plays a crucial role in the issuance and regulation of the dollar, the actual currency itself can be thought of as a public good. This is evident in the following aspects:

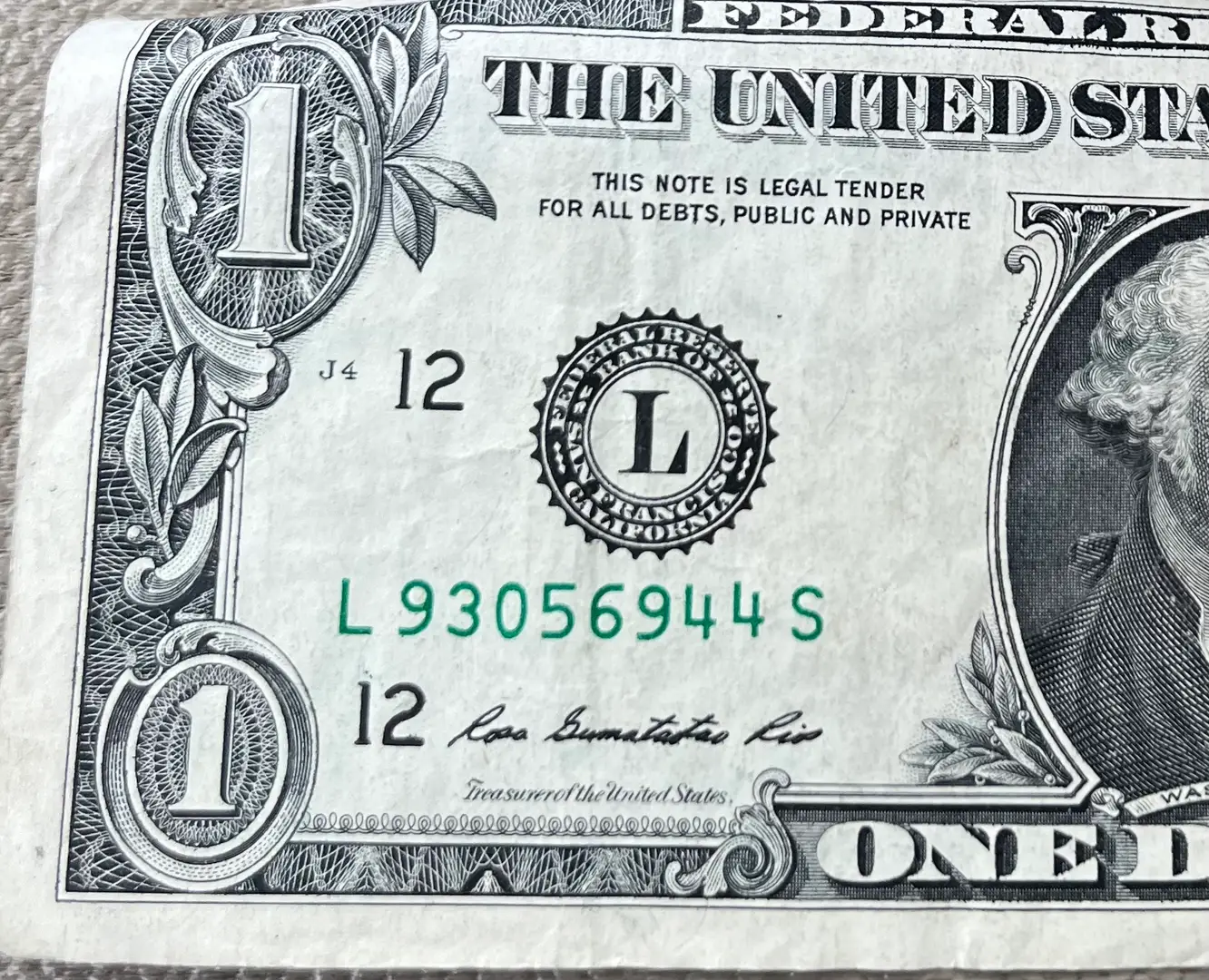

- Currency Issuance: The Federal Reserve is responsible for the creation of U.S. currency. This process is tightly controlled and regulated to ensure stability in the financial system. The physical notes and coins are produced by the Bureau of Engraving and Printing and the U.S. Mint, both of which are government agencies.

- Legal Tender: The U.S. dollar is designated as legal tender for all debts, public and private, under 31 U.S.C. § 5103. This means that it must be accepted if offered in payment of a debt, which reinforces its role as a public currency.

- Monetary Policy: The Federal Reserve conducts monetary policy to influence the economy, primarily through controlling interest rates and managing inflation. This includes setting the federal funds rate and engaging in open market operations, which are actions taken to adjust the amount of money circulating in the economy.

However, there are elements of the dollar that involve private sector participation:

- Commercial Banks: Banks operate within the Federal Reserve system and are authorized to create money through the lending process. When banks issue loans, they effectively create new deposits, which expands the money supply. This aspect of money creation is often referred to as fractional reserve banking.

- Digital Currencies: The rise of cryptocurrencies and digital payment systems has introduced private alternatives to traditional currency. While these are not officially recognized as legal tender, they reflect a growing trend towards privatization in financial transactions. For example, Bitcoin and other cryptocurrencies operate independently of government regulation, though their interaction with the dollar is increasingly significant.

- Payment Systems: Private companies like Visa, Mastercard, and PayPal provide payment processing services that facilitate transactions in U.S. dollars. These companies have developed systems that allow for rapid electronic payments, enhancing the efficiency of dollar transactions.

In conclusion, while the U.S. dollar is not fully privatized, it exists in a hybrid system where the Federal Reserve maintains control over its issuance and regulation, while the private sector plays a vital role in the distribution and facilitation of its use. This blend of public oversight and private innovation supports the dollar's status as a stable and widely accepted currency.

For further reading, you may refer to:

Related Posts

© 2026 Invastor. All Rights Reserved

User Comments